Free Checkbook Ledger Printable

adminse

Mar 27, 2025 · 7 min read

Table of Contents

Unlock Financial Clarity: Your Guide to Free Printable Checkbook Ledgers

What if effortlessly tracking your finances could be as simple as downloading a free printable checkbook ledger? This powerful tool empowers you to regain control over your spending and budgeting, laying the foundation for long-term financial success.

Editor’s Note: This comprehensive guide to free printable checkbook ledgers was published today to provide you with the latest information and resources for managing your personal finances effectively. We’ve explored various options, highlighting their benefits and helping you choose the best fit for your needs.

Why Free Printable Checkbook Ledgers Matter:

In today's digital age, many rely on budgeting apps and online banking. However, the tangible act of physically recording transactions offers unparalleled clarity and control. A free printable checkbook ledger provides a simple, accessible, and personalized way to:

- Visualize your cash flow: See your income and expenses side-by-side, providing a clear picture of your financial health.

- Improve budgeting accuracy: Track every transaction, preventing overspending and ensuring you stay within budget.

- Identify spending patterns: Analyze your records to pinpoint areas where you can save money and make better financial decisions.

- Simplify tax preparation: Maintain organized records for easy tax preparation at the end of the year.

- Boost financial literacy: The process of manual tracking improves your understanding of personal finance.

- Reduce reliance on technology: Offer a backup method for tracking finances, even in situations with limited internet access.

Overview: What This Article Covers:

This article dives deep into the world of free printable checkbook ledgers. We will explore various types of ledgers, their features, benefits, and how to choose the perfect one for your needs. We'll also discuss effective strategies for using your ledger and maintaining accurate records. Finally, we'll address common questions and provide practical tips for maximizing the benefits of using a printable checkbook ledger.

The Research and Effort Behind the Insights:

This guide is the result of extensive research, drawing upon personal finance expertise, user reviews, and analysis of numerous available free printable checkbook ledger templates. We've considered diverse needs and preferences to present a balanced and informative overview.

Key Takeaways:

- Understanding Checkbook Ledger Basics: A definition and explanation of the core components of a checkbook ledger.

- Types of Printable Checkbook Ledgers: An exploration of different formats and features available.

- Choosing the Right Ledger: Guidance on selecting a ledger that aligns with your individual needs and preferences.

- Effective Ledger Management Techniques: Strategies for maintaining accurate and organized records.

- Troubleshooting Common Issues: Solutions for overcoming challenges in using a printable checkbook ledger.

- Advanced Applications: Exploring how ledgers can be used beyond basic checkbook tracking.

Smooth Transition to the Core Discussion:

With a clear understanding of why utilizing a free printable checkbook ledger is beneficial, let's delve into the specifics, exploring the different types available and how to best utilize them for your financial well-being.

Exploring the Key Aspects of Free Printable Checkbook Ledgers:

1. Definition and Core Concepts:

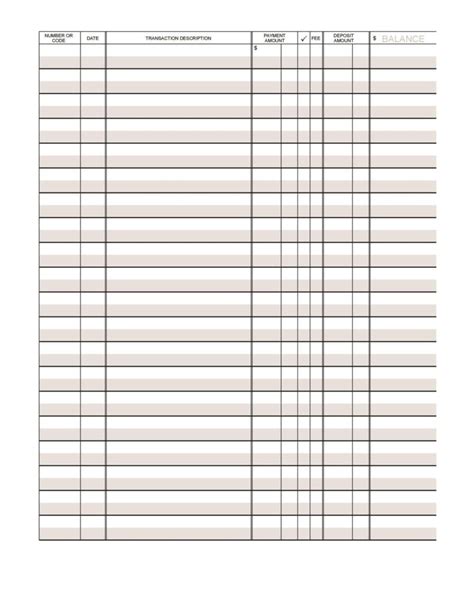

A checkbook ledger is a simple accounting tool used to track income and expenses related to a checking account. It typically includes columns for:

- Date: The date of each transaction.

- Description: A brief description of each transaction (e.g., "Groceries," "Rent," "Salary").

- Payment Method: Whether the transaction was a check, debit card, or cash.

- Check Number: The check number for checks written (if applicable).

- Payment/Debit: The amount paid out.

- Deposit/Credit: The amount received.

- Balance: The running balance of the account after each transaction.

2. Types of Printable Checkbook Ledgers:

Numerous free printable checkbook ledgers are available online, offering various features and formats:

- Basic Ledgers: These offer the essential columns mentioned above, ideal for simple tracking.

- Detailed Ledgers: Include additional columns for categories (e.g., "Utilities," "Entertainment"), allowing for more in-depth analysis.

- Multi-Account Ledgers: Allow tracking of multiple checking accounts, savings accounts, or even credit cards within a single ledger.

- Budgeting Ledgers: Integrate a budgeting component, allowing for comparison between actual spending and budgeted amounts.

- Year-at-a-Glance Ledgers: Provide a summary view of your finances for an entire year.

3. Applications Across Industries (and Personal Use):

While primarily used for personal finance, the principles of checkbook ledgers can be adapted for small businesses or freelancers to track income and expenses. This provides a simple, manual accounting system before transitioning to more complex software.

4. Impact on Innovation (and Financial Literacy):

Despite the rise of digital tools, the humble checkbook ledger remains relevant. Its simplicity fosters financial literacy by allowing users to directly interact with their financial data, building a stronger understanding of their spending habits.

Exploring the Connection Between Budgeting and Free Printable Checkbook Ledgers:

The relationship between budgeting and a free printable checkbook ledger is synergistic. A well-designed budget informs your financial goals, and the ledger helps you track your progress against those goals.

Key Factors to Consider:

- Roles and Real-World Examples: A budget provides targets for spending, and the ledger allows you to monitor adherence to that budget. For instance, if your budget allocates $300 for groceries monthly, the ledger will show if you are exceeding or falling short of this amount.

- Risks and Mitigations: Failing to reconcile your ledger with your bank statement can lead to inaccurate financial data. Regular reconciliation minimizes this risk.

- Impact and Implications: Accurate ledger maintenance empowers you to identify areas of overspending, adjust your budget effectively, and improve your financial health.

Conclusion: Reinforcing the Connection:

The combined use of a budget and a free printable checkbook ledger creates a powerful system for managing personal finances. By accurately tracking your spending against your budgeted amounts, you gain valuable insights into your financial behavior, enabling better financial decision-making.

Further Analysis: Examining Budgeting Strategies in Greater Detail:

Effective budgeting involves categorizing expenses, prioritizing needs over wants, and setting realistic goals. Various budgeting methods exist (e.g., 50/30/20 rule, zero-based budgeting), and choosing the right method depends on individual circumstances and preferences.

FAQ Section: Answering Common Questions About Free Printable Checkbook Ledgers:

- Q: What is the best type of printable checkbook ledger? A: The best type depends on your needs. Begin with a basic ledger if you’re new to tracking finances; if you need more detailed analysis, consider a ledger with category columns.

- Q: How often should I reconcile my ledger? A: Reconcile your ledger with your bank statement at least monthly to ensure accuracy.

- Q: Can I use a ledger for multiple accounts? A: Yes, some ledgers are designed for multiple accounts, while others require separate ledgers for each account.

- Q: What if I make a mistake in my ledger? A: Use a pencil so you can erase mistakes easily. Alternatively, neatly cross out incorrect entries and write the correct information beside them.

- Q: Are there any alternatives to a printable checkbook ledger? A: Yes, budgeting apps and spreadsheet software offer digital alternatives. However, many find the tangible nature of a physical ledger more beneficial.

Practical Tips: Maximizing the Benefits of Free Printable Checkbook Ledgers:

- Choose a clear and easy-to-read format: Select a ledger template with a layout that is visually appealing and easy to understand.

- Use a pen or pencil: Use a pen for permanent entries and a pencil for tentative entries that you might want to adjust later.

- Date every transaction promptly: Enter transactions as soon as they occur to maintain accuracy.

- Be consistent: Update your ledger regularly to avoid falling behind.

- Reconcile regularly: Compare your ledger balance to your bank statement to identify and correct any discrepancies.

- Categorize your expenses: Use categories to track where your money is going.

- Store your ledger safely: Keep your ledger in a safe and accessible place.

- Back up your information: Consider making copies of your ledger or scanning it digitally for backup.

Final Conclusion: Wrapping Up with Lasting Insights:

Free printable checkbook ledgers offer a powerful and accessible tool for managing personal finances. By using them effectively, you can gain clarity into your spending habits, create a budget, and make informed decisions to improve your financial well-being. The simplicity of a physical ledger can be surprisingly effective in fostering financial literacy and empowering you to take control of your financial future. Embrace the power of manual tracking to achieve lasting financial success.

Latest Posts

Latest Posts

-

Pdf Printable Meat Temperature Chart

Apr 01, 2025

-

Pdf Printable Kettlebell Workout

Apr 01, 2025

-

Pdf Printable Job Application

Apr 01, 2025

-

Pdf Printable Free Dollhouse Plans

Apr 01, 2025

-

Pdf Printable Emergency Card Template

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Free Checkbook Ledger Printable . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.