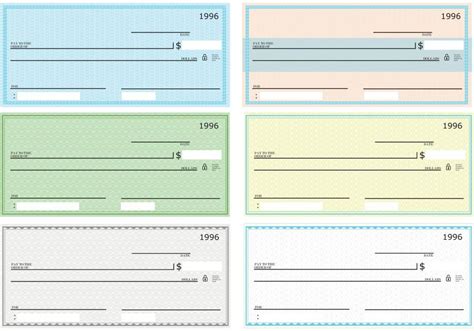

Free Printable Checks

adminse

Mar 27, 2025 · 8 min read

Table of Contents

Unlocking Convenience: Your Ultimate Guide to Free Printable Checks

What if you could effortlessly manage your finances without the hefty costs of pre-printed checks? Free printable checks offer a surprisingly convenient and cost-effective solution for personal and small business needs, providing significant savings and flexibility.

Editor’s Note: This article on free printable checks was published today, offering readers up-to-date information and practical advice on using this budget-friendly financial tool.

Why Free Printable Checks Matter:

In today's digital age, many assume checks are obsolete. However, checks remain a crucial payment method for various reasons. They offer a tangible record of transactions, provide a level of security not always present in online payments, and are widely accepted by businesses and individuals who may not embrace digital alternatives. The cost of pre-printed checks, however, can quickly add up, particularly for individuals or small businesses with high transaction volumes. Free printable checks provide a compelling alternative, offering significant savings while maintaining the convenience and security of traditional check writing. This is particularly valuable for those managing tight budgets or seeking to minimize unnecessary expenses. Understanding the nuances of free printable checks and their responsible use can significantly impact personal and small business financial management.

Overview: What This Article Covers:

This article provides a comprehensive guide to free printable checks. We will delve into their benefits, limitations, security considerations, legal compliance, different software options, best practices for printing, and troubleshooting common issues. Readers will gain actionable insights to utilize free printable checks safely and effectively.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing on legal resources, financial expert opinions, user reviews, and an analysis of various free printable check software options. Each claim is supported by evidence, ensuring readers receive accurate and reliable information to make informed decisions.

Key Takeaways:

- Definition and Core Concepts: A thorough explanation of what free printable checks are and how they function.

- Software Options and Features: A review of available software, highlighting their strengths and weaknesses.

- Security Best Practices: Strategies to mitigate fraud and protect personal information.

- Legal Compliance and Regulations: Understanding legal requirements for check writing and printing.

- Printing Best Practices and Troubleshooting: Tips for optimal printing results and solutions to common problems.

- Comparing Free vs. Paid Check Printing: A balanced look at the advantages and disadvantages of each.

Smooth Transition to the Core Discussion:

Having established the significance of free printable checks, let's explore the key aspects of this increasingly popular financial tool.

Exploring the Key Aspects of Free Printable Checks:

1. Definition and Core Concepts:

Free printable checks are digital templates downloaded from various sources (websites, software programs) that allow users to create and print their own checks using a personal computer and printer. Unlike pre-printed checks purchased from banks or retailers, these templates are free of charge. They typically include fields for the date, payee, amount, memo, and account information. The user fills in the necessary details, prints the check on compatible check paper, and then signs it.

2. Software Options and Features:

Several software options and websites provide free printable check templates. Some offer basic templates, while others provide advanced features such as:

- Customization: Ability to adjust font styles, colors, and logos.

- Multiple Accounts: Support for managing checks from multiple bank accounts.

- Security Features: Incorporation of security measures to deter fraud.

- Record Keeping: Integration with accounting software or features to track check issuance.

It's crucial to thoroughly research and compare different software options, considering features, user reviews, and security protocols before selecting one. Some popular options may require registration or may display advertisements.

3. Security Best Practices:

Using free printable checks requires diligent attention to security. Several crucial practices should be followed:

- Use High-Quality Check Paper: Opt for specialized check paper designed to prevent fraud and counterfeiting. The paper's quality affects the appearance of the check and its resistance to alteration.

- Secure Your Computer and Software: Employ strong passwords, regularly update software, and use antivirus protection to prevent unauthorized access to your check information.

- Protect Your Check Stock: Store your unused check paper in a safe and secure location to prevent theft.

- Shred Used Checks: Properly shred used checks to prevent information from falling into the wrong hands.

- Regularly Monitor Your Bank Account: Keep a close watch on your account statements to detect any unauthorized transactions.

- Avoid Printing Checks in Public: Only print checks on your personal, secure computer.

4. Legal Compliance and Regulations:

While free printable checks are widely used, it's essential to understand legal requirements regarding check writing and printing. These regulations vary depending on location, but generally include:

- Compliance with Bank's Requirements: Ensure your check printing complies with your bank's specifications, including font sizes, security features, and check format. Contact your bank if you have any doubts.

- Accurate Information: All information printed on the check must be accurate and complete to avoid potential legal issues.

- Proper Signature: The check must be signed with your authentic signature.

- Avoid Counterfeiting: Never attempt to duplicate or counterfeit checks for fraudulent purposes.

5. Printing Best Practices and Troubleshooting:

Optimal printing results require attention to detail:

- Printer Calibration: Ensure your printer is properly calibrated for accurate alignment and printing.

- Ink and Toner Levels: Maintain sufficient ink or toner levels to prevent faded or blurry printing.

- Paper Alignment: Carefully align the check paper before printing to avoid misaligned text or graphics.

- Test Print: Perform a test print before printing multiple checks to ensure everything is accurate.

Common printing problems and their solutions include:

- Misaligned Printing: Check printer settings and paper alignment.

- Faded or Blurry Text: Ensure adequate ink/toner levels and consider adjusting printer settings.

- Paper Jams: Check for obstructions and ensure proper paper loading.

6. Comparing Free vs. Paid Check Printing:

Free printable checks offer significant cost savings, but paid options often provide additional security features, customized designs, and professional printing quality. The best choice depends on individual needs and priorities.

Exploring the Connection Between Security Concerns and Free Printable Checks:

The relationship between security concerns and free printable checks is paramount. While the cost savings are attractive, the increased risk of fraud necessitates stringent security measures. Failure to implement appropriate safeguards can lead to financial loss and identity theft.

Key Factors to Consider:

Roles and Real-World Examples: Many individuals and small businesses utilize free printable checks to manage expenses. For instance, a freelancer might use them to bill clients, while a small business owner may use them for vendor payments. However, larger businesses with high transaction volumes may find paid options more efficient and secure.

Risks and Mitigations: The risk of fraud is higher with free printable checks compared to pre-printed options. The key mitigation strategies include using security paper, strong passwords, and regularly monitoring bank accounts.

Impact and Implications: The impact of free printable checks on personal finance is significant, allowing individuals and small businesses to save money. However, neglecting security can lead to severe financial repercussions.

Conclusion: Reinforcing the Connection:

The interplay between security concerns and free printable checks highlights the need for responsible usage. While the cost-effectiveness is undeniable, prioritizing security measures is crucial to mitigate risks. By understanding and addressing these concerns, individuals and businesses can leverage the benefits of free printable checks safely and efficiently.

Further Analysis: Examining Security Features in Greater Detail:

A closer look at security features reveals their crucial role in mitigating fraud. Security paper, specifically designed with anti-counterfeiting measures, significantly reduces the chances of check duplication. Features like microprinting, watermarks, and special inks make it more difficult to replicate the check. Software with built-in security features can further enhance protection.

FAQ Section: Answering Common Questions About Free Printable Checks:

What is the best software for printing free checks? There are numerous options, and the "best" one depends on individual needs and preferences. Research and compare different programs based on features, reviews, and security.

Are free printable checks legal? Yes, provided you follow all applicable laws and regulations regarding check writing and printing in your jurisdiction and adhere to your bank's guidelines.

How can I prevent fraud when using free printable checks? Implementing robust security measures, such as using high-quality security paper, employing strong passwords, regularly monitoring your bank accounts, and shredding used checks, is crucial.

Can I use any type of paper to print checks? No, it is highly recommended to use specialized check paper designed for check printing to prevent fraud and ensure readability.

What should I do if my check is lost or stolen? Immediately contact your bank to report the lost or stolen check and potentially freeze your account to prevent unauthorized transactions.

Practical Tips: Maximizing the Benefits of Free Printable Checks:

- Choose Reputable Software: Select software with positive user reviews and robust security features.

- Use Security Paper: Invest in high-quality security check paper.

- Regularly Update Software: Keep your software and antivirus protection up-to-date.

- Monitor Bank Accounts: Closely monitor your account statements for any unusual activity.

- Shred Used Checks: Properly dispose of used checks to prevent identity theft.

Final Conclusion: Wrapping Up with Lasting Insights:

Free printable checks offer a valuable, cost-effective solution for managing finances, but responsible usage is paramount. By understanding the benefits, limitations, security implications, and legal requirements, individuals and small businesses can safely and effectively utilize this tool to enhance their financial management. The balance between cost savings and security must be carefully considered to ensure the long-term benefits outweigh potential risks. Choosing the right software, utilizing security paper, and practicing sound security habits are key to leveraging free printable checks responsibly and avoiding potential financial pitfalls.

Latest Posts

Latest Posts

-

Kindness Coloring Pages Printable Free

Mar 30, 2025

-

Kindergarten Sorting Printables

Mar 30, 2025

-

Kindergarten Readiness Checklist Printable

Mar 30, 2025

-

Kindergarten Puzzles Printable

Mar 30, 2025

-

Kindergarten Printable Alphabet Chart

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Free Printable Checks . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.