Printable Payment Log

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Unlock Financial Clarity: The Ultimate Guide to Printable Payment Logs

What if effortlessly tracking your income and expenses could significantly reduce financial stress and boost your business's efficiency? A well-maintained printable payment log is the key to achieving this financial clarity, providing a simple yet powerful tool for managing your finances.

Editor’s Note: This comprehensive guide to printable payment logs was published today to provide readers with up-to-date information and actionable strategies for effective financial record-keeping. Whether you're a freelancer, small business owner, or individual managing personal finances, this guide offers valuable insights and practical templates.

Why Printable Payment Logs Matter: Relevance, Practical Applications, and Industry Significance

In today's fast-paced world, meticulous financial record-keeping is no longer a luxury; it's a necessity. A printable payment log offers a tangible and accessible solution for managing both income and expenses. Its applications are vast, spanning across various sectors:

-

Freelancers and independent contractors: Tracking payments from clients is crucial for invoicing, tax preparation, and cash flow management. A payment log simplifies this process, minimizing the risk of missed payments or discrepancies.

-

Small business owners: Maintaining accurate financial records is essential for securing loans, attracting investors, and complying with tax regulations. A payment log provides a structured approach to managing income and expenses, ensuring compliance and facilitating informed business decisions.

-

Personal finance management: Individuals can use a payment log to track personal income and expenses, facilitating budgeting, identifying spending patterns, and achieving financial goals. This simple tool empowers individuals to take control of their finances.

-

Non-profit organizations: Precise record-keeping is critical for accountability and transparency in non-profit operations. A payment log ensures accurate tracking of donations, grants, and expenditures, maintaining financial integrity.

Overview: What This Article Covers

This article provides a comprehensive exploration of printable payment logs. We'll delve into the benefits, different types of logs, essential features, creation methods, and practical applications. Readers will learn how to create their own customized logs, utilize existing templates, and leverage this tool to enhance their financial management practices. We'll also examine the integration of payment logs with other financial tools and strategies for maintaining accuracy and security.

The Research and Effort Behind the Insights

This article is the result of extensive research, combining insights from accounting best practices, financial management experts, and user experiences. We've analyzed various printable payment log templates and considered the needs of diverse users to offer practical and relevant information. The goal is to empower readers with the knowledge and tools necessary for effective financial record-keeping.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of what constitutes a printable payment log and its fundamental principles.

- Practical Applications: Real-world examples of how payment logs are utilized across different industries and personal finance scenarios.

- Customization and Template Selection: Guidance on choosing the right template or creating a custom log based on individual needs.

- Integration with Other Financial Tools: Strategies for incorporating payment logs into broader financial management systems.

- Security and Best Practices: Tips for ensuring the accuracy, security, and longevity of payment records.

Smooth Transition to the Core Discussion:

With a foundational understanding of the importance of printable payment logs, let's delve into the specifics, exploring their various formats, functionalities, and best practices for effective implementation.

Exploring the Key Aspects of Printable Payment Logs

1. Definition and Core Concepts:

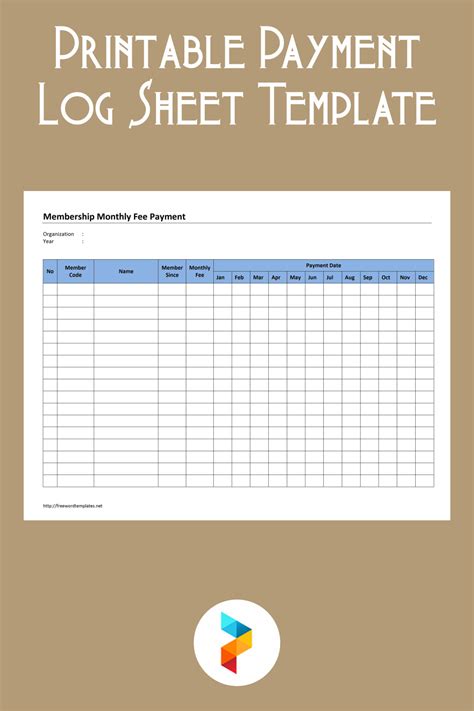

A printable payment log is a document, typically a spreadsheet or table, designed to record financial transactions. It provides a structured way to track incoming and outgoing payments, including details like date, description, payment method, amount, and payee or payer. The core purpose is to provide a clear, auditable record of all financial activity.

2. Applications Across Industries:

The versatility of printable payment logs extends across numerous sectors:

- E-commerce Businesses: Tracking online payments through various gateways like PayPal, Stripe, or Shopify.

- Retail Stores: Recording cash, credit card, and check transactions.

- Service-Based Businesses: Tracking payments for services rendered, including invoices issued and payments received.

- Real Estate Agents: Recording commissions and other related payments.

- Personal Use: Tracking income from various sources (employment, investments, etc.) and personal expenditures.

3. Challenges and Solutions:

While simple in concept, challenges can arise:

- Inconsistent Record-Keeping: Addressing this requires establishing a routine for regular log updates.

- Data Loss or Damage: Utilizing digital backups and multiple copies mitigates this risk.

- Lack of Integration: Choosing compatible software or using cloud storage can alleviate this issue.

4. Impact on Innovation:

Although seemingly basic, the consistent use of payment logs has contributed to advancements in accounting software and financial management tools. These logs serve as the foundation for automated bookkeeping and reporting systems.

Closing Insights: Summarizing the Core Discussion

Printable payment logs are an indispensable tool for individuals and businesses of all sizes. Their simplicity belies their power in streamlining financial management, enhancing transparency, and facilitating better decision-making. By embracing this simple yet effective tool, you can significantly improve your financial organization and clarity.

Exploring the Connection Between Digital Tools and Printable Payment Logs

While printable payment logs offer a tangible approach, the integration with digital tools significantly enhances their utility:

- Spreadsheet Software (Excel, Google Sheets): These provide functionalities like formulas for automatic calculations (totals, balances), data sorting and filtering, and easy data export to other applications.

- Accounting Software: Many accounting programs can import data from spreadsheets, streamlining the process of generating financial reports and tax documents.

- Cloud Storage (Google Drive, Dropbox): Storing digital copies ensures data backup and accessibility from multiple devices.

Key Factors to Consider:

- Roles and Real-World Examples: Integrating a digital payment log with accounting software enables automatic generation of financial reports, eliminating manual data entry. For example, a small business owner can directly import transaction data from their payment processing system into their accounting software, automating the creation of profit and loss statements.

- Risks and Mitigations: The risk of data loss can be minimized by regularly backing up digital files to a cloud service or external hard drive.

- Impact and Implications: The seamless integration of digital tools and printable payment logs improves efficiency, reduces errors, and simplifies the overall financial management process.

Conclusion: Reinforcing the Connection

The synergistic relationship between printable payment logs and digital tools provides a robust and efficient financial management system. By combining the tangibility of a printed log with the power of digital tools, businesses and individuals can optimize their financial record-keeping, paving the way for improved financial health and decision-making.

Further Analysis: Examining Spreadsheet Software in Greater Detail

Spreadsheet software like Microsoft Excel or Google Sheets offers a powerful platform for enhancing the utility of printable payment logs. Their features significantly reduce manual effort and enhance accuracy:

- Formulas: Automate calculations such as totals, subtotals, and balances, eliminating manual calculation errors.

- Data Validation: Ensure data consistency and accuracy by setting rules for data entry (e.g., requiring numerical input for amounts).

- Data Filtering and Sorting: Quickly identify specific transactions based on criteria like date, payment method, or amount.

- Charts and Graphs: Visualize financial data, making it easier to understand trends and patterns in income and expenses.

FAQ Section: Answering Common Questions About Printable Payment Logs

Q: What is a printable payment log?

A: A printable payment log is a document, often a spreadsheet or table, used to record and track all financial transactions, including income and expenses. It provides a detailed record of each transaction, including date, description, payment method, and amount.

Q: What are the benefits of using a printable payment log?

A: Benefits include improved financial organization, accurate record-keeping for tax purposes, better budgeting and expense tracking, and enhanced financial transparency.

Q: How do I create a printable payment log?

A: You can either create a custom log in a spreadsheet program (Excel, Google Sheets) or download a pre-made template from various online sources.

Q: How often should I update my payment log?

A: It's best to update your payment log regularly, ideally daily or at least weekly, to maintain accuracy and avoid missing any transactions.

Practical Tips: Maximizing the Benefits of Printable Payment Logs

- Choose the Right Format: Select a format that best suits your needs and preferences. A simple spreadsheet is often sufficient, but more complex logs might be necessary for businesses with higher transaction volumes.

- Consistency is Key: Update the log regularly to maintain accurate and up-to-date financial records.

- Use Clear Descriptions: Provide detailed descriptions of each transaction to facilitate easy understanding and reconciliation.

- Regular Backups: If using a digital log, back up your data regularly to prevent data loss.

- Categorize Expenses: Categorize expenses for easier budgeting and financial analysis.

Final Conclusion: Wrapping Up with Lasting Insights

Printable payment logs represent a fundamental yet powerful tool for effective financial management. By implementing a consistent system of record-keeping, whether through a simple printed log or a sophisticated digital spreadsheet, individuals and businesses can gain valuable insights into their finances, optimize resource allocation, and ultimately achieve greater financial success. The effort invested in maintaining accurate records translates directly into improved financial health and peace of mind.

Latest Posts

Latest Posts

-

Printable Spider Web Stencil

Apr 07, 2025

-

Printable Spice Labels

Apr 07, 2025

-

Printable Spice Jar Labels

Apr 07, 2025

-

Printable Spelling Test Paper

Apr 07, 2025

-

Printable Spell Book Harry Potter

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Printable Payment Log . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.