Printable Personal Financial Statement Template

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Uncover the Secrets to Financial Clarity: Your Ultimate Guide to Printable Personal Financial Statements

What if effortlessly managing your finances was as simple as downloading a template? A well-structured personal financial statement is the cornerstone of financial health and achieving your financial goals.

Editor's Note: This comprehensive guide to printable personal financial statement templates was published today, offering you the most up-to-date information and actionable advice to improve your personal financial management.

Why Printable Personal Financial Statements Matter:

In today's complex financial landscape, understanding your financial position is paramount. A personal financial statement acts as a snapshot of your current financial health, allowing you to track assets, liabilities, and net worth. This crucial document isn't just for high-net-worth individuals; it's an essential tool for everyone, from students managing student loans to entrepreneurs tracking business performance, and even retirees monitoring their retirement funds. Understanding your financial standing empowers you to make informed decisions about budgeting, saving, investing, and debt management. It also becomes an invaluable tool when applying for loans, seeking investment opportunities, or simply gaining a clearer picture of your financial trajectory. The ability to create and regularly update a personal financial statement is a key component of long-term financial wellness.

Overview: What This Article Covers

This article delves deep into the world of printable personal financial statement templates. We'll explore the different types of statements, how to fill them out correctly, the importance of regular updates, and the many ways they can be beneficial to your overall financial well-being. We'll also discuss the benefits of using a template versus creating one from scratch and address some frequently asked questions. By the end, you'll have the knowledge and resources to effectively manage your personal finances using a simple, yet powerful, tool.

The Research and Effort Behind the Insights

This guide is the product of extensive research, drawing from reputable financial sources, expert opinions, and real-world examples. We've analyzed various personal finance templates to identify the best features and provide you with actionable advice. Our goal is to provide you with accurate, unbiased information to empower you to take control of your financial future.

Key Takeaways:

- Understanding the Components: A clear definition of assets, liabilities, and net worth, and how they relate to your overall financial health.

- Template Selection: Guidance on choosing the right template based on your individual needs and financial complexity.

- Accurate Data Entry: Best practices for accurate and consistent data entry to ensure the statement reflects your true financial position.

- Regular Updates and Analysis: The importance of consistent updates and the analysis of trends to inform financial decisions.

- Practical Applications: Real-world examples of how a personal financial statement can be used for various financial goals.

Smooth Transition to the Core Discussion:

Now that we've established the importance of a personal financial statement, let's explore the specifics of printable templates, how to choose the right one, and how to effectively use it to improve your financial management.

Exploring the Key Aspects of Printable Personal Financial Statement Templates

1. Definition and Core Concepts:

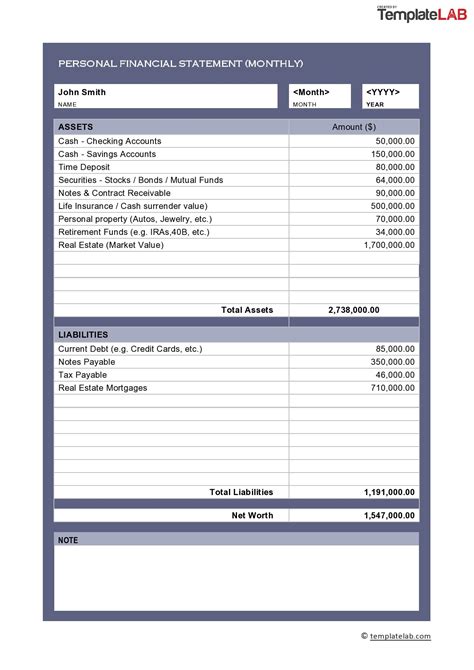

A personal financial statement is a summary of your financial position at a specific point in time. It typically consists of two core components: a balance sheet and a cash flow statement (though many simpler templates focus solely on the balance sheet).

-

Balance Sheet: This shows your assets (what you own), liabilities (what you owe), and net worth (the difference between assets and liabilities). A positive net worth indicates that your assets exceed your liabilities, while a negative net worth suggests that your liabilities exceed your assets.

-

Cash Flow Statement (Optional): This statement tracks your income and expenses over a period, typically a month or a year. It helps you understand where your money is coming from and where it's going, allowing you to identify areas for potential savings or adjustments.

2. Applications Across Industries:

While predominantly used for personal finance, the principles of a personal financial statement extend to various applications:

- Small Business Owners: Track business assets, liabilities, and profitability.

- Investors: Monitor portfolio performance and make informed investment decisions.

- Loan Applications: Provide lenders with a clear picture of your financial health.

- Estate Planning: Assess your financial assets for inheritance purposes.

3. Challenges and Solutions:

The biggest challenge with personal financial statements is maintaining accuracy and consistency. Inaccuracies can lead to misinformed decisions. Solutions include:

- Regular Updates: Aim for monthly or quarterly updates to reflect current financial standing.

- Organized Record Keeping: Maintain organized records of all financial transactions.

- Digital Tools: Utilize spreadsheet software or financial management apps to simplify data entry and tracking.

4. Impact on Innovation:

The increasing availability of digital tools and financial management software has greatly improved the ease of creating and maintaining personal financial statements. This allows individuals to focus more on financial analysis and planning rather than manual data entry.

Closing Insights: Summarizing the Core Discussion

A printable personal financial statement template is a powerful tool for anyone looking to gain control of their finances. By accurately reflecting your assets, liabilities, and net worth, it provides a clear picture of your financial health, facilitating better decision-making and promoting long-term financial well-being.

Exploring the Connection Between Data Accuracy and Printable Personal Financial Statement Templates

The relationship between data accuracy and the effectiveness of a personal financial statement template is critical. Inaccurate data renders the statement useless, leading to flawed financial planning and potentially disastrous outcomes.

Roles and Real-World Examples:

Accurate data ensures a realistic representation of your financial position. For example, misreporting the value of a house or forgetting a credit card balance will significantly skew your net worth, leading to incorrect conclusions about your financial health. Conversely, accurate data allows you to track progress towards financial goals, identify areas needing improvement, and demonstrate financial stability to lenders or investors.

Risks and Mitigations:

Risks associated with inaccurate data include:

- Poor Financial Decisions: Based on false assumptions about your financial position.

- Rejected Loan Applications: Due to a misrepresentation of your financial health.

- Missed Investment Opportunities: Because of an inaccurate assessment of your investment capacity.

Mitigation strategies include:

- Regular Reconciliation: Compare your statement to bank and credit card statements to ensure accuracy.

- Detailed Record Keeping: Maintain meticulous records of all financial transactions.

- Professional Advice: Seek professional financial advice for complex financial situations.

Impact and Implications:

The impact of accurate data is far-reaching. It empowers informed decision-making, facilitates access to credit, and contributes to long-term financial success. Inaccurate data, on the other hand, can lead to financial instability and missed opportunities.

Conclusion: Reinforcing the Connection

The importance of accurate data cannot be overstated when using a printable personal financial statement template. Diligence in data entry and regular reconciliation are crucial for generating a reliable snapshot of your financial health, enabling effective financial planning and ultimately, achieving your financial goals.

Further Analysis: Examining Data Management Strategies in Greater Detail

Effective data management is crucial for creating accurate and useful personal financial statements. This goes beyond simply entering numbers; it involves organizing, storing, and accessing financial information efficiently. Consider using spreadsheet software like Microsoft Excel or Google Sheets, which allow for formula-based calculations and automatic updates. Financial management software can also simplify the process by aggregating data from various accounts. Employing a consistent filing system for physical documents further improves organization.

FAQ Section: Answering Common Questions About Printable Personal Financial Statement Templates

Q: What is a personal financial statement?

A: A personal financial statement is a summary of your financial position at a specific point in time, showing your assets, liabilities, and net worth.

Q: How often should I update my personal financial statement?

A: Ideally, update your statement monthly or quarterly to track progress and identify any changes in your financial situation.

Q: What types of assets should I include?

A: Include all assets you own, such as cash, investments, real estate, vehicles, and personal belongings of significant value.

Q: What types of liabilities should I include?

A: Include all debts you owe, such as mortgages, loans, credit card balances, and other outstanding payments.

Q: Where can I find printable personal financial statement templates?

A: Many websites offer free printable templates, including personal finance websites, government resources, and online template providers. Search online for "printable personal financial statement template" to find various options.

Q: What if I don't know the exact value of an asset?

A: Use your best estimate. If you’re unsure about the value of an asset, you can consult online resources or a professional appraiser.

Practical Tips: Maximizing the Benefits of Printable Personal Financial Statement Templates

- Choose the right template: Select a template that meets your needs and level of financial complexity.

- Gather all your financial information: Collect bank statements, investment records, loan documents, and other relevant financial data.

- Enter your data accurately: Double-check all entries to ensure accuracy.

- Review and analyze your statement regularly: Identify trends and make informed financial decisions.

- Use the statement for goal setting: Track progress towards your financial goals, such as saving for a down payment or paying off debt.

Final Conclusion: Wrapping Up with Lasting Insights

A printable personal financial statement template is an invaluable tool for managing your personal finances. By providing a clear picture of your financial health, it empowers you to make informed decisions, track progress towards your goals, and achieve lasting financial well-being. The key to success lies in choosing the right template, entering accurate data, and regularly reviewing your statement to maintain financial clarity. Take control of your financial future today by downloading and utilizing a personal financial statement template.

Latest Posts

Latest Posts

-

Printable Starbucks Gift Cards

Apr 07, 2025

-

Printable Star Wars Pictures

Apr 07, 2025

-

Printable Star Wars Greeting Cards

Apr 07, 2025

-

Printable Star Of Bethlehem

Apr 07, 2025

-

Printable Standard Wrench Size Chart

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Printable Personal Financial Statement Template . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.