Printable Texas Bill Of Sale

adminse

Apr 07, 2025 · 9 min read

Table of Contents

Unlocking the Power of Printable Texas Bills of Sale: A Comprehensive Guide

What if simplifying your Texas property transactions was as easy as printing a document? A well-structured printable Texas bill of sale can be the cornerstone of a legally sound and hassle-free transfer of ownership.

Editor’s Note: This article provides comprehensive information on printable Texas bills of sale as of October 26, 2023. Laws and regulations can change, so it's crucial to consult with legal counsel for advice tailored to your specific situation. This information is for educational purposes and does not constitute legal advice.

Why Printable Texas Bills of Sale Matter:

In Texas, a bill of sale serves as crucial evidence of a transaction involving the sale of personal property. While not always legally required, a properly executed bill of sale protects both the buyer and seller from potential disputes later on. It provides irrefutable proof of the sale, including the date, items sold, price, and identities of the involved parties. This is particularly vital for high-value items, antique goods, vehicles (though a title transfer is also required), or items with complex ownership histories. A printable version offers convenience and accessibility, making it a practical choice for many transactions.

Overview: What This Article Covers:

This in-depth guide will explore everything you need to know about printable Texas bills of sale. We'll delve into the essential elements required for a legally sound document, common mistakes to avoid, the importance of proper record-keeping, and considerations for specific types of property. We’ll also address frequently asked questions and provide practical tips for creating and utilizing a printable Texas bill of sale effectively.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon Texas statutes, legal precedents, and best practices for document creation. The information presented aims to provide readers with accurate and trustworthy guidance. We have consulted various legal resources and real estate professionals to ensure the accuracy and relevance of the content.

Key Takeaways:

- Definition and Core Concepts: Understanding the legal definition and function of a bill of sale in Texas.

- Essential Elements: Identifying the crucial components required for a valid Texas bill of sale.

- Different Types of Property: Addressing the nuances of bills of sale for various items, such as vehicles, firearms, and real estate (with caveats).

- Avoiding Common Mistakes: Highlighting common errors and how to prevent them.

- Record-Keeping Best Practices: Emphasizing the importance of storing your bill of sale securely.

- Legal Considerations: Understanding when a bill of sale might be insufficient and professional legal advice is necessary.

Smooth Transition to the Core Discussion:

Now that we've established the importance of a properly executed bill of sale, let's examine the key aspects that contribute to its legal validity and efficacy in Texas.

Exploring the Key Aspects of Printable Texas Bills of Sale:

1. Definition and Core Concepts:

A Texas bill of sale is a written agreement that documents the transfer of ownership of personal property from a seller to a buyer. It's not a substitute for other required legal documents, such as a title transfer for vehicles or a deed for real estate, but it serves as compelling evidence of the transaction. Its purpose is to clearly outline the terms of the sale, thereby protecting both parties involved.

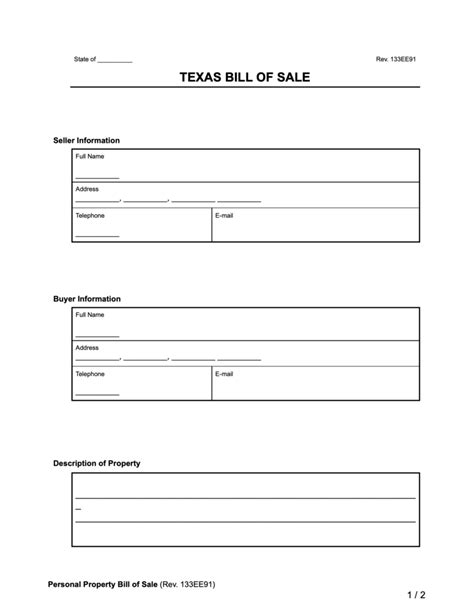

2. Essential Elements of a Valid Texas Bill of Sale:

A legally sound Texas bill of sale must include the following critical information:

- Date of Sale: Clearly state the date the transaction occurred.

- Seller Information: Include the full legal name(s) and address(es) of the seller(s).

- Buyer Information: Include the full legal name(s) and address(es) of the buyer(s).

- Description of Property: Provide a detailed and accurate description of the personal property being sold. This should include the make, model, serial number (if applicable), and any other identifying features. Avoid vague language. For example, instead of "a car," specify "a 2018 Toyota Camry, VIN: 1234567890."

- Purchase Price: State the total purchase price in numerical and written form.

- Payment Method: Indicate how payment was made (e.g., cash, check, money order).

- Signatures: Both the seller and buyer must sign and date the document. Witnesses may not be legally required for a valid bill of sale in Texas but are often recommended, particularly for high-value items.

- Tax Implications: While not explicitly part of the bill of sale itself, understanding sales tax implications is crucial. Texas has a sales tax that applies to most purchases. The seller may need to collect and remit sales tax, depending on the nature of the sale and the seller's status as a business or individual.

3. Different Types of Property and Specific Considerations:

While a bill of sale serves a general purpose, certain types of property may require additional considerations:

- Vehicles: A bill of sale for a vehicle is usually part of the process, but a properly transferred title from the Texas Department of Motor Vehicles (TxDMV) is required for legal ownership transfer. The bill of sale supports the title transfer.

- Firearms: Federal law requires licensed dealers to keep records of firearm sales. A bill of sale is not a substitute for compliance with federal and state firearm regulations.

- Real Estate: A bill of sale is not used for the sale of real estate in Texas. The transfer of real estate ownership requires a deed, properly recorded with the county clerk.

- Antique and Collectible Items: For high-value antiques or collectibles, a detailed description, including appraisals or professional documentation, is highly recommended.

4. Avoiding Common Mistakes:

Several common mistakes can invalidate or weaken a bill of sale:

- Incomplete or Inaccurate Information: Ensure all fields are filled out accurately and completely.

- Ambiguous Descriptions: Use specific and unambiguous language to describe the property.

- Missing Signatures: Both seller and buyer must sign the document.

- Incorrect Dates: Use the correct date of the transaction.

- Lack of Witness Signatures: While not always legally required, witness signatures add a layer of credibility and can be helpful in case of disputes.

5. Record-Keeping Best Practices:

Once you've created and signed your bill of sale, proper storage is essential. Keep a copy for your records and provide a copy to the other party involved in the transaction. Consider storing your bill of sale in a secure location, like a fireproof safe or a digital, password-protected document storage system.

6. Legal Considerations:

While a well-prepared bill of sale offers significant protection, it's crucial to understand its limitations. For complex transactions or high-value items, seeking legal advice from a qualified Texas attorney is advisable. An attorney can help you navigate potential legal complexities and ensure the transaction is legally sound.

Exploring the Connection Between Digital Signatures and Printable Texas Bills of Sale:

The use of digital signatures is increasingly common in document management. While a handwritten signature is perfectly acceptable for a Texas bill of sale, using a digital signature, if both parties agree and the platform used is compliant with applicable laws, provides additional security, time-saving benefits, and a readily accessible digital copy. However, it's essential to ensure the digital signature platform adheres to Texas legal standards for electronic signatures.

Key Factors to Consider:

- Roles and Real-World Examples: Digital signatures can streamline the process, making it easier for parties located geographically apart to complete the transaction. Businesses regularly use digital signatures for contracts and bills of sale.

- Risks and Mitigations: The key risk lies in using a non-compliant digital signature platform. Choose a reputable and legally compliant platform to avoid issues.

- Impact and Implications: Digital signatures can significantly improve efficiency and security compared to traditional handwritten signatures.

Conclusion: Reinforcing the Connection:

The integration of digital signatures enhances the efficacy and security of printable Texas bills of sale. By choosing a reliable digital signature platform, parties can leverage technology to facilitate secure and efficient transactions.

Further Analysis: Examining the Implications of Non-Compliance in Greater Detail:

Using a non-compliant digital signature or neglecting crucial elements within a bill of sale can have serious legal implications. Disputes may arise, leading to costly litigation and potential legal challenges to the validity of the transaction. In such cases, the lack of a proper bill of sale or improperly obtained digital signature could significantly disadvantage one or both parties involved.

FAQ Section: Answering Common Questions About Printable Texas Bills of Sale:

Q: Is a printable Texas bill of sale legally binding?

A: Yes, a properly completed and signed printable Texas bill of sale is legally binding, provided it contains all the necessary elements discussed above.

Q: Do I need a witness to sign my bill of sale?

A: While not legally required in all cases, having witnesses sign the bill of sale is highly recommended, especially for high-value items. It adds an extra layer of proof and can prevent future disputes.

Q: Can I use a generic template from the internet?

A: You can use a template, but ensure it includes all the essential elements mentioned in this article. Consider consulting with legal counsel to confirm its suitability for your specific situation.

Q: What happens if there's a dispute after the sale?

A: A well-documented bill of sale serves as strong evidence in a legal dispute. However, the outcome depends on the specifics of the dispute and the evidence presented.

Practical Tips: Maximizing the Benefits of a Printable Texas Bill of Sale:

- Use a clear and easy-to-read format: Make the document straightforward and easy to understand for all parties involved.

- Double-check all information: Review every field to ensure accuracy before printing and signing.

- Keep multiple copies: Maintain copies for both the buyer and the seller.

- Consider professional legal advice: Seek legal counsel if you have questions or concerns about the transaction or the bill of sale itself.

Final Conclusion: Wrapping Up with Lasting Insights:

A printable Texas bill of sale is a powerful tool for securing personal property transactions. By understanding its essential components, avoiding common pitfalls, and employing best practices for creation and storage, both buyers and sellers can confidently conduct legal and efficient transfers of ownership. Remember that while a bill of sale is valuable, it may not replace other legally required documents in specific circumstances, emphasizing the importance of seeking legal counsel when necessary. With careful preparation and attention to detail, a printable Texas bill of sale can provide peace of mind and protect your interests in personal property transactions.

Latest Posts

Latest Posts

-

Printable United States Map Coloring Page

Apr 07, 2025

-

Printable United Kingdom Flag

Apr 07, 2025

-

Printable Unisex Bathroom Sign

Apr 07, 2025

-

Printable Union Jack

Apr 07, 2025

-

Printable Unicorn Horn

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Printable Texas Bill Of Sale . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.